Simply put, a business valuation is the formal process of determining what your business is worth.

Business valuers are accredited individuals, generally university trained with formal accounting training and experience who help come up with a value on your business by analysing your P&L’s, business model and business systems to determine a value.

Business valuations can be determined using a variety of valuation methodologies.

Valuator has a team of experienced valuation experts who specialise in the analysis of a businesses value. If you want to sell your business or are using a valuation for a dispute or to find out what your business is worth, then Valuator can help you!

There are a variety of variables that we use to determine what your business is worth. Here is a list of some of the factors that we take into account in our valuation:

Generally we can perform a valuation if you think you need it for the following reasons: Curious about it’s value, family matter, partnership issues, determine the value of your shares, divorce settlements, retirement planning and selling your business.

Generally we can complete a smaller business in 2-4 weeks. Medium business in 4-6 weeks and large business in 6-8 weeks. This can be sped up if all the relevant financial documents are organised.

Based in Sydney we travel to all locations both inner city and outer Sydney.

Having served multiple clients in Melbourne before as well as large national clients with multi city locations, if you are in Melbourne be assured we will be able to help you determine your companies true value.

If you are looking for a business valuer in Brisbane we can also help. We have had clients in Brisbane, the Gold Coast, Townsville and Mackay.

What will the valuation report look like?

Call Us at our Sydney office on (02) 46310184 to discuss your business valuation requirements. We provide business valuation services in Sydney, Melbourne and Brisbane.

There are four commonly used valuation methodologies used for a small business valuation:

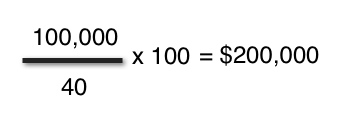

When you buy a business you are also buying the potential profits that it may generate in the future. Future maintainable earnings is the most common small business valuation methodology and looks at the adjusted earnings of a business and the rate of return buyers can expect from the business by capitalising it’s future earnings. Return on investment is the level of risk a purchaser is willing to take on the business, based on a combination of macro and micro factors. Generally when people buy businesses they seek a 20% – 100% return on investment.

How it works

E.g. a business makes $100,000 per year. You want a rate of return of 40% therefore you divide 100,000/40 = 2,500. Then multiply by 100 equals $250,000.

You may apply an earnings multiple to your business. For example take your EBIT (Earnings before interest and tax) and multiply it by 2.

How It Works So for our business that is making $100,000 per year.

You may search for similar sales of your business to find comparable sales data.

How It Works

You may make your valuation based on the assets of the business. An asset valuation takes all the assets of the company and then subtracts liabilities. This method is normally used when the company is going to be shut down.

How It Works

NOTE: good will is not included in an asset valuation. The assumption is the business will not be trading in the future.